Forclosure Prevention

Are you facing foreclosure?

Washington Homeownership Resource Center operates Washington’s official homeownership hotline and is here to guide you through this difficult time.

The foreclosure process can be overwhelming, but you are not alone. There are steps that you can take today that may help prevent foreclosure and allow you to keep your home.

The Washington Homeownership Resource Center (WHRC) is committed to supporting homeowners during this challenging time by helping you understand your rights, access resources and tools, and connect to advocates that provide hands on help. Foreclosure prevention help is free when it’s about the home you live in. There can be a fee for foreclosure help on investment or vacation homes.

Call us today to talk to a specialist who can provide you with resources tailored to your situation.

In Washington state, you have rights through the Foreclosure Fairness Act (FFA) – watch this short video to learn more about the foreclosure process and how the FFA protects you. Then, call our Hotline.

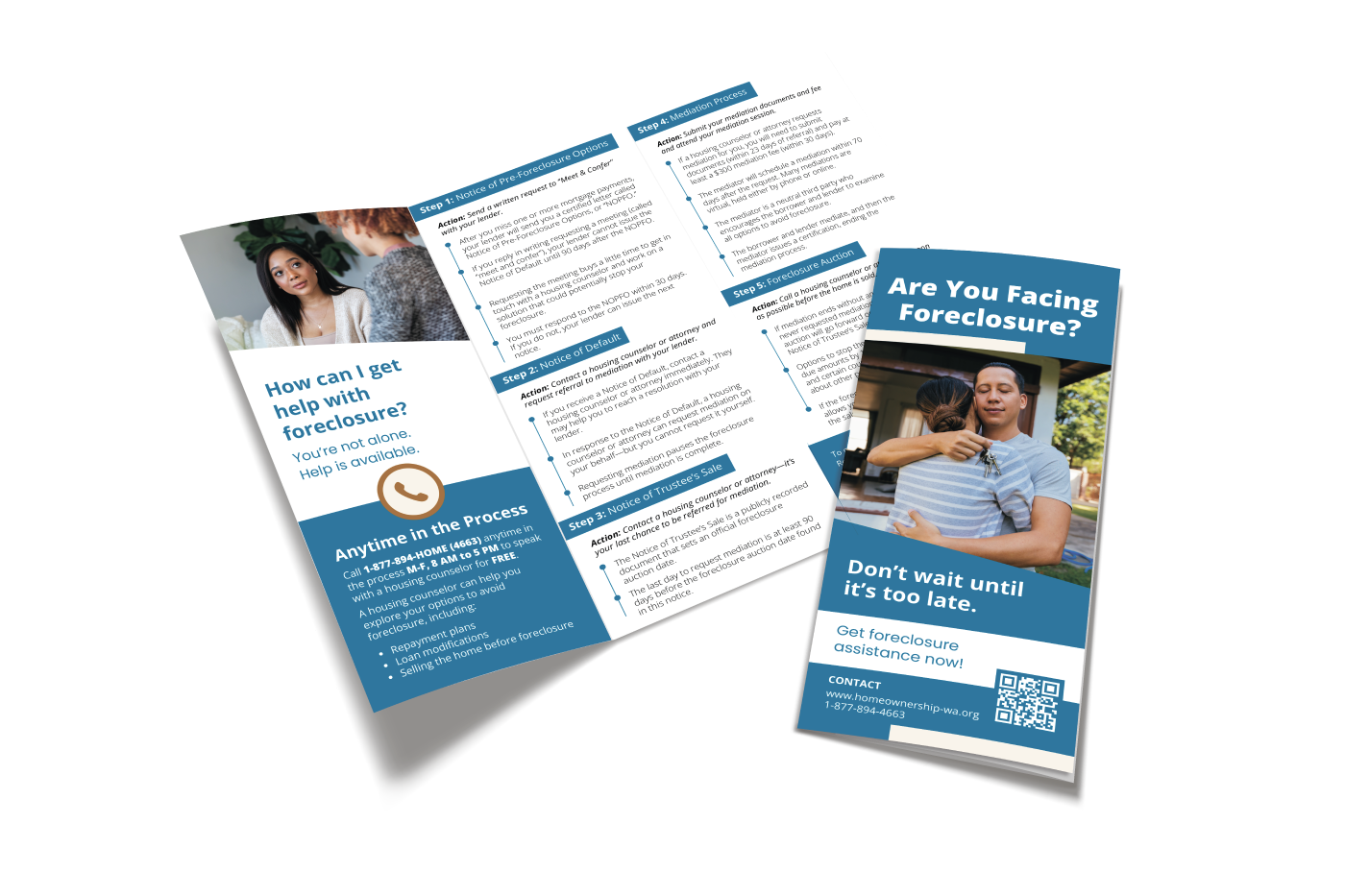

Washington State Foreclosure Prevention Pamphlet

Together with our partners in the statewide foreclosure prevention network, we created a pamphlet with reliable and important information on foreclosure in Washington state. It may help you understand where you are in the foreclosure process and what options and resources are available.

Frequently Asked Questions

Click on each question to learn more about foreclosure

Foreclosure in Washington is governed by the Foreclosure Fairness Act (FFA). Under this Act, loan servicers must send three notices to homeowners on a specific timeline before they can foreclose on a home. The notices are the Notice of Pre-Foreclosure Options, the Notice of Default, and the Notice of Trustee’s Sale. Homeowners have certain rights at different points in the process, including the right to meet with their loan servicer to discuss non-foreclosure options and the right to mediation with their loan servicer. WHRC’s Homeownership Hotline can help you understand where you are in the process and what rights are available to you. A HUD-certified housing counselor or legal aid attorney can help you exercise your rights.

The Washington Homeownership Resource Center’s (WHRC) services are available free of charge to any homeowner in Washington state in danger of foreclosure related to their mortgage, property taxes, or HOA dues. We also help residents of Washington state who have questions related to home purchase, refinance, reverse mortgages, or repair assistance.

When you call WHRC, an Information and Referral Specialist will ask you questions about your situation and your mortgage, property taxes, and/or HOA dues. Based on your location and specific needs, the specialist will refer you to the appropriate counseling, legal aid, and/or government agencies. If you have received any foreclosure-related notices from your lender, the specialist will help you take action and respond appropriately.

The Department of Housing and Urban Development (HUD) sponsors housing counseling agencies across the country to assist homeowners in avoiding foreclosure. Housing counselors are experts who are on your side and who will walk you through the foreclosure process and the steps you need to take to prevent foreclosure. Some housing counseling agencies require that you take a class before meeting with a counselor and all require the completion of an intake packet. A counselor will review your household budget, help you develop a crisis budget, if necessary, and help you understand what options may be available to you to avoid foreclosure. The counselor helps you negotiate with your loan servicer and present them with a complete and accurate application for a loan modification, if that is the option you determine is best for you. Homeowners who work with a Housing Counselor to apply for a loan modification have a success rate of 86% versus only 12% on their own.

Foreclosure prevention counseling from a HUD-approved counseling agency is ALWAYS free when it is regarding the home you live in. If you seek counseling related to a vacation home or investment property, there may be a fee for counseling. If you are solicited by a company that claims to be able to modify your mortgage or provide other foreclosure prevention assistance for an upfront fee, it may be a scam. Do not sign anything! Call our Hotline and get connected to a legitimate housing counselor at a HUD-approved housing counseling agency. We can also help you report foreclosure prevention scams to the appropriate authorities.

Once you choose a housing counseling agency to work with, we recommend that you only work with them. Foreclosure is a long process and may require many rounds of communication with your loan servicer. It will be easier for you and your counselor if you are able to track the process together. Additionally, there are a limited number of housing counselors in Washington, so working with more than one counselor takes up time that could be going to help another homeowner.

Many of the HUD-approved housing counseling agencies serve homeowners statewide and are not limited to a specific area. Housing counseling and the completion of paperwork can be done online, by fax, or on the phone if you are not able to meet in person. We encourage you to work with a housing counselor for help even if you have to do so online or by phone.

To ensure you are working with a HUD-approved counseling agency, call the WHRC Homeownership Hotline to be connected to an approved counselor or ask your housing counselor if they are approved by the United States Department of Housing and Urban Development (HUD) and verify their information online. If you suspect a scam, you should contact the Washington Attorney General’s Office consumer protection line at 1.800.551.4636 or visit their website at www.atg.wa.gov. You can also contact the Federal Trade Commission at 1.877.382.4357

Housing counseling agencies should not charge you for their services if you are facing foreclosure on the home you live in. Any organization that contacts you and promises you a new mortgage, charges upfront fees, advises you to stop paying your mortgage or to stop talking to your mortgage company, and/or calls from out of state is probably too good to be true. These companies use television and internet advertisements as well as personal solicitations targeting homeowners in default. If you suspect a scam, you should contact the Washington Attorney General’s Office consumer protection line at 1.800.551.4636 or visit their website at www.atg.wa.gov. You can also contact the Federal Trade Commission at 1.877.382.4357. WHRC’s Hotline staff are available to help you connect to additional resources to report scams. If you’ve already been a victim of a scam, call the Hotline right away.

The best action you can take after receiving a notice is to call the WHRC Hotline and let us connect you to a housing counselor or legal aid attorney. There are three required notices, but you may receive other notices as well. If you live in the home, you have certain rights and they vary depending on what notice you have received. It can be helpful for Hotline staff if you know which notice you received when you call us.

The three legally required notices are:

- Notice of Pre-Foreclosure Options (NOPFO)

- Notice of Default (NOD)

- Notice of Trustee’s Sale (NOTS)

Throughout the foreclosure process, whether you work with a counselor or on your own, you should save every notice or communication you receive from your bank. If you are working with a counselor, you should share any communication from your bank with your counselor, so they can advise you on what to do.

In Washington state, the Notice of Pre-Foreclosure Options (NOPFO) is the first of three notices your loan servicer is required to send you after you miss a mortgage payment. You may receive other notices from your lender indicating you have missed a payment, but the NOPFO always includes the phrase “important rights for homeowners.” This notice informs you of your right to an in-person or phone meeting with your lender, called a “Meet and Confer,” regarding the missed payment(s) and your options. You should respond to the NOPFO within 30 calendar days from the date on the notice to request the meeting and we recommend doing so by certified mail so you have proof of its send date and receipt. If you respond in time, the bank must meet with you and must wait 90 days from the date of the NOPFO before posting a Notice of Default, which is the next required notice. If you choose not to respond, the lender can issue the Notice of Default 30 days after the date on the NOPFO. We highly recommend that you work with a counselor and have them with you during the meeting with your loan servicer. Contact the WHRC Hotline to learn more and/or get connected to a housing counselor.

You should respond to the Notice of Pre-Foreclosure Options by certified mail and keep the returned green receipt that shows the lender has received your request. Include your loan number, the date you received the notice, and either request an in-person meeting in your county or a meeting via telephone with your lender. The Notice of Pre-Foreclosure Options should include an address to which you can send the response. You can use this template to request the meeting:

If you receive a Notice of Default (NOD), contact the Homeownership Hotline IMMEDIATELY. You have from the date on the Notice of Default until 20 days after the date on the Notice of Trustee Sale to have a housing counselor or attorney request mediation on your behalf. Because you cannot request mediation on your own, it is important that you get connected to either a housing counselor or attorney quickly. The sooner you contact the Hotline about your Notice of Default, the more time you have to complete the necessary paperwork required for a mediation request. Additionally, if you request mediation before the Notice of Trustee’s Sale is issued, the foreclosure timeline stops while you attend mediation with your lender.

The Notice of Trustee Sale (NOTS) is the third and final notice in the foreclosure process. This notice is publicly recorded in your county and includes the date on which the Trustee will sell your home at auction if your situation is not resolved before then. The FFA requires that the auction date is no sooner than 120 days from the recording date on the NOTS.

If you receive a Notice of Trustee’s Sale (NOTS), contact the Homeownership Hotline IMMEDIATELY. You have 20 days after the recording date on the Notice of Trustee’s Sale to have a housing counselor or attorney request mediation on your behalf. Because you cannot request mediation on your own, it is important that you get connected to either a housing counselor or attorney. The sooner you contact the Hotline about your Notice of Trustee’s Sale, the more time you have to complete the necessary paperwork required for a mediation request.

Mediation is the process where homeowners, a representative from the mortgage company (also known as the beneficiary), a housing counselor or attorney, and a trained mediator discuss alternatives to foreclosure. It is a powerful tool in preventing foreclosure. A mediator cannot order the beneficiary to reach a resolution in the homeowner’s favor, but they are trained to help both parties reach an agreement. Mediation does not guarantee that the homeowner will receive a loan modification or other favorable outcome, but the Foreclosure Fairness Act requires the homeowner and beneficiary to participate in good faith and many homeowners are able to retain their home as a result of the mediation process.

You can access deeds, mortgage documents, liens, notices, subdivision, and real estate contracts at the County Recorder’s office. Depending on the county and the document, you may be able to find them online.

Use the following lookup tools to see if Fannie Mae or Freddie Mac owns your mortgage:

You can file a complaint against your bank or financial institutions from the following list:

- Federal Deposit Insurance Corporation, Consumer Response Center (FDIC) : 877.275.3342 (Hours of Operation: 8:00 a.m. -8:00 p.m. Eastern Time)

- Office of the Comptroller of the Currency

- Federal Trade Commission, Division of Financial Practices

- Office of the Washington Attorney General

- The Washington State Department of Financial Institutions Consumer Financial Protection Bureau – Hotline: 1.855.411.CFPB (2372)

WHRC does not sell client information to any party. We take basic intake information in order to understand your situation and make the appropriate referrals to agencies that may be able to assist you, such as HUD-approved housing counseling agencies and legal aid providers. We share the intake information you provide us with the referral agency upon making the referral, to help them assist you as quickly as possible. Learn more about WHRC’s Privacy Policy.